We deal in also domestic market in India and provide all agro commodities to Multinational Corporate Companies & many Individual clients for hedging in NCDEX futures market.

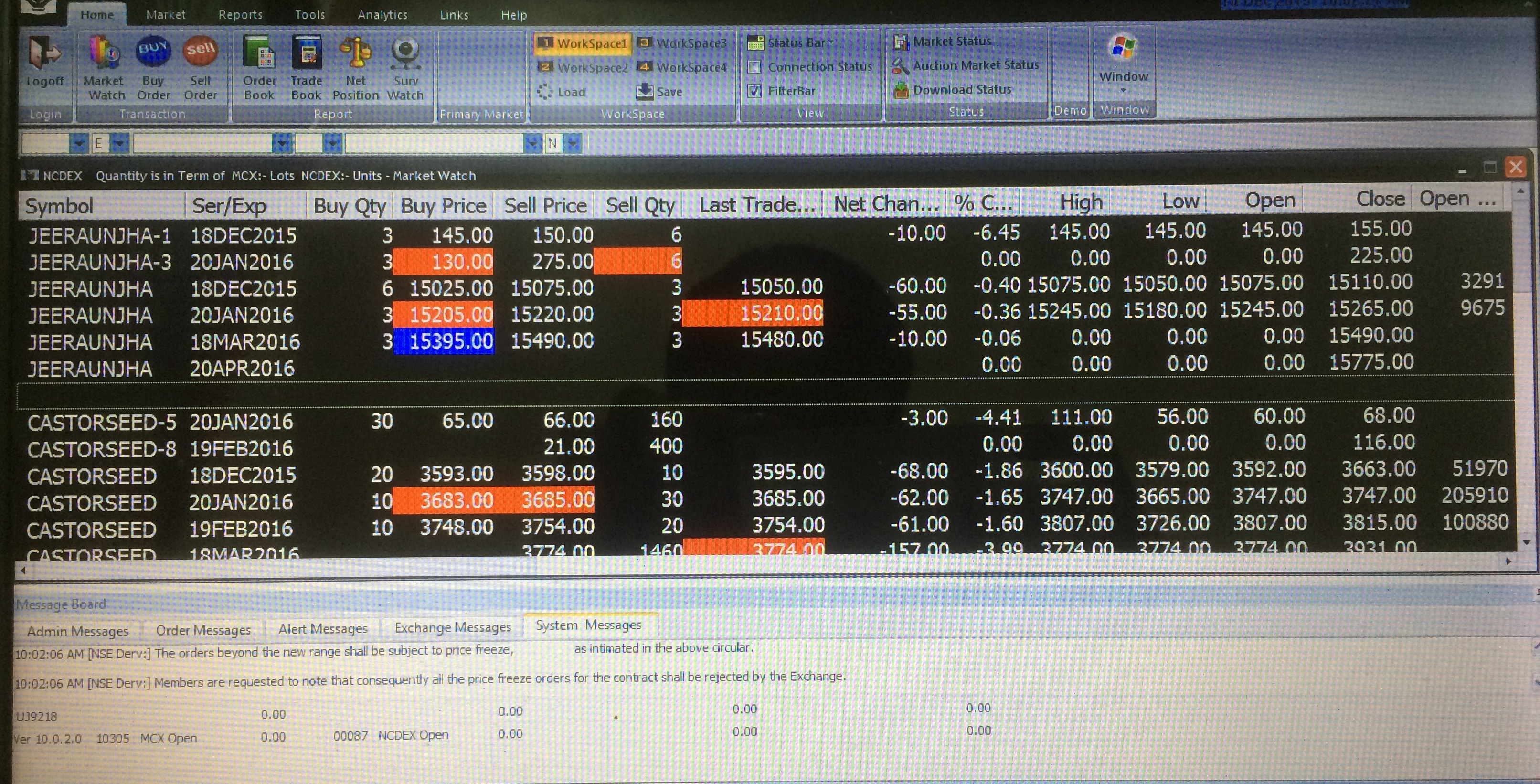

Cumin (Jeera) futures contract was launched on NCDEX platform on February 2004 and has witnessed considerable volatility since its launch. Good availability in physical markets provides cash and carry opportunity to arbitragers. It serves as a hedging platform for the Producers and Exporters. The Cumin contract is highly liquid and provides easy entry and exit to a speculator. Thus the Cumin (Jeera) contract provides space for every investor category.

Given that castor seed have considerable price volatility and that the export realizations of castor oil have also vacillated between years, Exchange traded castor seed futures are ideal for price risk management needs of the processors, exporters and end users. Those with no natural exposure to castor seed trade can also benefit by undertaking 'cash-and-carry' arbitrage and 'calendar spread'. Speculators can take directional view on future prices and accordingly take positions in castor seed futures.

Given that guar seed have considerable price volatility and that the export realizations have also vacillated between years, Exchange traded guar seed futures are ideal for price risk management needs of the processors, exporters and end users. Those with no natural exposure to guar trade can also benefit by undertaking 'cash-and-carry' arbitrage and 'calendar spread'. Speculators can take directional view on future prices and accordingly take positions in guar seed futures.

Guar gum futures are trading on exchange platform since July,2004. Exchange traded guar seed futures are ideal for price risk management needs of the processors, exporters and end users.

Coriander futures contract was launched on August 2008. The supply fluctuation due to underlying fundamental factors leads to high price volatility. Inadequate storage period (6-8 months) effects availability and thus the prices during low availability months, such supply fluctuations provide opportunity to a speculator. For hedgers it minimizes price risk. Due to good availability in physical markets arbitragers can make use of the futures platform to make riskless profits. Thus the Coriander contract provides space for every investor category.

RMSEED have considerable price volatility in the physical market as well as futures. Exchange traded RMSEED futures are ideal for price risk management needs of the processors, traders, physical participants and end users. Those with no physical exposure to RMSEED trade can also benefited by undertaking 'cash-and-carry' arbitrage and 'calendar spread'. Speculators can take directional view on future prices and accordingly take positions in RMSEED seed futures. Jaipur is the basis centre for RMSEED. Alwar, Kota, Sriganga Nagar, Bikaner, Agra & Hapur as a additional delivery centres.